Passenger train services • Main line services / Ticketing • High speed Rail • Italy • NTV-Italo

➤ See also: AVE Renfe – Avlo (Renfe) – Eurostar (since 2024) – Frecciarossa – ICE – InOui – Iryo – Lyria – Ouigo SNCF

➤ See also: High speed train in France – High speed train in Germany – High speed train in Italy – High speed train in Japan

Note: For educational purpose only. This page is meant purely as a documentation tool and has no legal effect. It is not a substitute for the official page of the operating company, manufacturer or official institutions. It cannot be used for staff training, which is the responsibility of approved institutions and companies.

In brief

Nuovo Trasporto Viaggiatori, better known by its trade name NTV-Italo, is a privately-owned high-speed rail company that began operating on 28 April 2012. It is the second railway company to be set up in Italy, following the aborted attempt in 2010 by Arenaway. It is probably the most successful example to date of a private high-speed rail company in Europe. Giuseppe Sciarrone, one of the heads of NTV, sets the tone: ‘ In Italy, we will operate under an open access system, but we must also compete with the FS (Ferrovie dello Stato) group, which has 150 years of experience, with all its strengths and weaknesses ’.

What kind of high-speed policy?

The Italian high-speed model has more in common with the German model than the French model. The aim is to link a string of towns, which in the case of the Turin-Milan-Venice line are fairly close to each other.

Operator: Nuovo Trasporto Viaggiatori (NTV)

Subsidiary / shareholders: 50% GIP + Allianz SPA, 50% MSC

Sector: Passengers transport

Type of service: Main line

International transport: no

First services: 28 April 2012

Train type: HST Emu

Manufacturer(s): Alstom

Driver service: own

Officiel website: https://www.italotreno.com/en

Social media: :

Similar companies : AVE and AVLO Renfe – Frecciarossa Trenitalia – ICE Deutsche Bahn – iryo – NTV-Italo – Ouigo España – Shinkansen – TGV SNCF

Regular routes

➤ Turin – Milan – Bologna – Florence – Rome – Naples – Salerno

➤ Venice – Padua – Bologna – Florence – Rome – Naples

➤ Bolzano – Verona – Bologne – Florence – Rome – Naples

➤ Genoa – Milan – Brescia – Verona – Venice

Rolling stock (past and present)

Alstom

2010 – …

Alstom

2018 – …

Birth of the business

Formed in 2006, this wholly private company is owned by a number of leading Italian industrialists: Luca Di Montezemolo (boss of Ferrari), Diego Della Valle (CEO of leather goods manufacturer Tod’s), Gianni Punzo (CEO of logistics company CIS) and Giuseppe Sciarrone, the indispensable rail man who previously worked for Trenitalia and Rail Traction Company. Remarkably, this is Europe’s first private high-speed company, with the aim of competing with Trenitalia’s high-speed lines, which are in the process of being restructured. The founding team is familiar with the inner workings of the administration and keeps in touch with the political elite at the top of the State. These are things that help…

In January 2008, NTV changed its corporate structure when Intesa Sanpaolo acquired a stake, followed in October by Société Nationale des Chemins de Fer Français (SNCF). The French state-owned group’s entry into a competitor’s business led to a falling out between Trenitalia and SNCF, putting an end to the Artesia cooperation in December 2011 and counter-attacking with another private company: Thello.

From the outset, NTV made an ambitious choice, opting for a massive investment of over €1 billion, including €628 million just for the purchase of 25 new high-speed trains that only existed on paper. The new company plans to offer three classes of travel, similar to those offered by airlines. This was to shake up a rail model historically based on two classes of travel. From the outset, NTV’s cost structure was to be similar to that of low-cost airlines, and strategic plans called for the recruitment of 1,000 direct employees (including 100 drivers and 700 on-board staff) to reach a target of 8 million customers by 2014. NTV had also decided to outsource certain tasks such as train maintenance, catering and ticketing.

The arrival of this competition was not without its difficulties, as the legislation was not yet truly drafted in favour of competition, as we shall see below. Entering a rail market always takes time. In March 2011, NTV’s board of directors stated that the start of the liberalised market had been slow and speculated that the Italian rail network operator (RFI) was trying to obstruct the entry of its trains into the Italian market by amending the network access document.

The literature of the time indicates that several authors and some newspapers had highlighted various practical obstacles that NTV had to face and overcome in order to succeed in its entry. The FS group, which is a holding company for the infrastructure manager, replied that the changes would not harm NTV in any way. Nevertheless, NTV had to wait a year to obtain its rail licence from the Ministry of Transport. It took even longer to obtain authorisation to operate the new trains from the Italian National Agency for Railway Safety (ANSF), which was obtained in March 2012, after three years of examining the dossier.

Start of service

The launch of the first trains on 28 April 2012 was accompanied by a series of legal grey areas, from which the historic company Trenitalia took full advantage, particularly with regard to access to essential facilities. This led to the rapid bankruptcy of Arenaways, another entrepreneur who tried the private train a little too early…’. In Italy, the independent regulator only started work at the end of 2013, after the arrival of NTV-Italo, which had to operate for a year and a half in an environment where there was no competent regulatory authority overseeing the market ’, Andrea Giuricin, special advisor to NTV-Italo and CEO of TRA Consulting, recalls to the International Railway Journal. Giancarlo Scolari, editorial director of the specialist website Ferrovie.it, recalls that NTV’s initial problem was that the company had chosen to compete head-on with Trenitalia’s ‘fat’, i.e. high speed. It was a daring move. The fact remains that the team of founders of NTV-Italo is pulling out all the stops to make its voice heard in the media…

Initially, in order to stifle the media effect, RFI, the station manager, took advantage of the legal uncertainty to confine NTV-Italo to Rome-Ostiense and Milan-Rogoredo, stations less well served by all the country’s trains. NTV-Italo also wanted to showcase a new approach to station lounges, known as ‘Casa Italo’. The Casa de Roma-Ostiense, for example, was the subject of a zany controversy when the operator RFI put up a very attractive fence all around the platforms and the entrance to the former Air-terminal station, completely enclosing the NTV lounge, in accordance with an agreement that was perfectly legal but apparently badly drawn up when the premises were purchased.

>>> See photos from Roma Corriere on the day of the inauguration

Similar incidents were taking place elsewhere. The state manager was not to be pleased: the then Under-Secretary for Infrastructure, Guido Improta, who attended the inauguration of the ‘fenced house’, roundly criticised the events, declaring that ‘ it pains me to see that there is no common cause for the difficulties facing our country (…) the existence of these physical barriers convinces me of the urgent need to create a strong regulator ’.

Not only did RFI remove the fence ten days later, but in October 2013 the Italian competition authority officially concluded that FS group subsidiaries Trenitalia and RFI had deliberately tried to exclude NTV from the rail market. RFI’s attitude also changed later in the year, when it agreed to allocate NTV train paths for services linking Rome to Milan and Venice departing from the capital between 7 a.m. and 8 a.m., which RFI had always opposed, arguing that there were traffic conflicts between subsidised regional services and NTV-Italo trains.This time, the new Italian train is well and truly launched…

Station access policy is also changing. In stations, RFI and FS subsidiaries Grandi Stazioni and Centostazioni had to allow the installation of customer assistance desks and self-service ticket machines for NTV within a specified timeframe, as well as reserving space for these installations. Grandi Stazioni also had to give NTV fair access to commercial spaces in the stations it serves by December 2014 at the latest, and charges and rental conditions must not distinguish between self-service operators and Trenitalia. Passenger information systems for NTV services were installed on the platforms at Milan-Garibaldi and Naples.

The economic results at the end of 2014 showed that this was well below expectations and led to the renegotiation of the financing terms, with the introduction of Intesa and Generali into the shareholding. Despite a sharp rise in passenger numbers, NTV posted a net loss of 62 million euros. Revenues were well below forecasts and well below the break-even point, threatening the very existence of the company. Faced with the prospect of bankruptcy, SNCF’s shareholder jumped ship. But the two competing operators shared one conviction: the price war had its limits and was threatening the whole business model…

2015 – A breath of fresh air

Everything changed when the Italian government decided to melt rail tolls. A 15% reduction in high-speed access charges came into force on 19 September, following the publication of a ministerial decree, reducing the high-speed toll from €15 / km to €13 / km at the time of Ntv’s business plan. But what followed was more revolutionary, as the toll plummeted to around €8.7/km. In 2014, NTV was still paying €120 million in access fees to RFI, while its turnover had peaked at €250 million.

The management team is also up for renewal. Flavio Cattaneo became the group’s CEO at the beginning of 2015, while SNCF left. One of Cattaneo’s first priorities as CEO was to plan an extension of the NTV network from December 2018 to serve new destinations and increase frequency on existing routes by strengthening the train fleet with the addition of eight Alstom Pendolino sets.

The other important action concerned NTV’s debts of €681 million, which were rescheduled with the aim of repaying 70% by 2028 and the remaining 30% by 2033.

Efficiency

One of the keys to NTV-Italo’s renaissance is better use of assets, in particular more productive use of rolling stock, and innovation in the relationship between the company and the customer to achieve a personal, even individual, relationship. Greater use of revenue management and the ability to reduce operating costs through innovation are other elements.

NTV also raised its capital of 60 million euros following an agreement reached on 17 July 2015, although only certain shareholders participated: Messrs Diego della Valle, Luca di Montezemolo, Gianni Punzo, Intesa San Paolo, Generali, Mrs Isabella Serragnoli, Alberto Bombassei and Cattaneo himself with a 4% share, which he will continue to hold despite his departure from the company. 2015 ended profitably for the company and Cattaneo’s restructuring plan worked rather well. In 2017, NTV chairman Montezemolo declared that ‘ now we can recognise that the transport authorities have established sound and fair rules for correct competition ’.

2018 – First change of shareholders

Following debt restructuring and a €100 million recapitalisation in 2015, NTV-Italo was able to make its first profits in 2016. Turnover was also up at 30 June 2017.

But in February 2018, NTV-Italo’s shareholders decided to accept a €1.98 billion takeover bid from international fund manager Global Infrastructure Partners III. GIP offered €1.94bn to own 100% of NTV, plus €30m in dividends paid to shareholders and €10m to cover costs incurred in the now aborted listing process on the Milan stock exchange. The proposal also confirms that the fund is prepared to assume Italo-Ntv’s €400 million debt, giving a total offer of €2.5 billion.

In the Peninsula, people are crying colonization! Founder Luca Cordero di Montezemolo’s scathing response: “ When we were about to close in 2014, to take the accounts to court, nobody lifted a finger, only Intesa SanPaolo. And even now, when the GPI offer came in, I haven’t seen anyone proposing alternative hypotheses, of being prepared to take more than 40 percent. The American group is a great sign of optimism about [investment] opportunities in our country, an act of confidence that is particularly important at times like these. ” Regarding the aborted IPO project: “ The advisors explained to us that to get the price GIP put on the table, it would have taken 2-3 years with the stock market at its peak, which is difficult to predict. We’re entrepreneurs, not Samaritans. Of course, I’m both happy and a little regretful, because I’ve seen the birth of a creature that should fill this country with pride…”. And on the subject of the former SNCF shareholder: “ I remember when many people accused us of being the gateway, the Trojan horse for the French. When the crisis hit [ed. note 2014], they left. Competition in this country has come a long way, but still needs a cultural leap…”

While there have been many questions about this foreign takeover of NTV, it is likely that the GIP group is using the Italo deal to enter the EU rail market and acquire know-how that can be used in other countries. Indeed, this was the strategy of SNCF, which otherwise had no business in Italy.

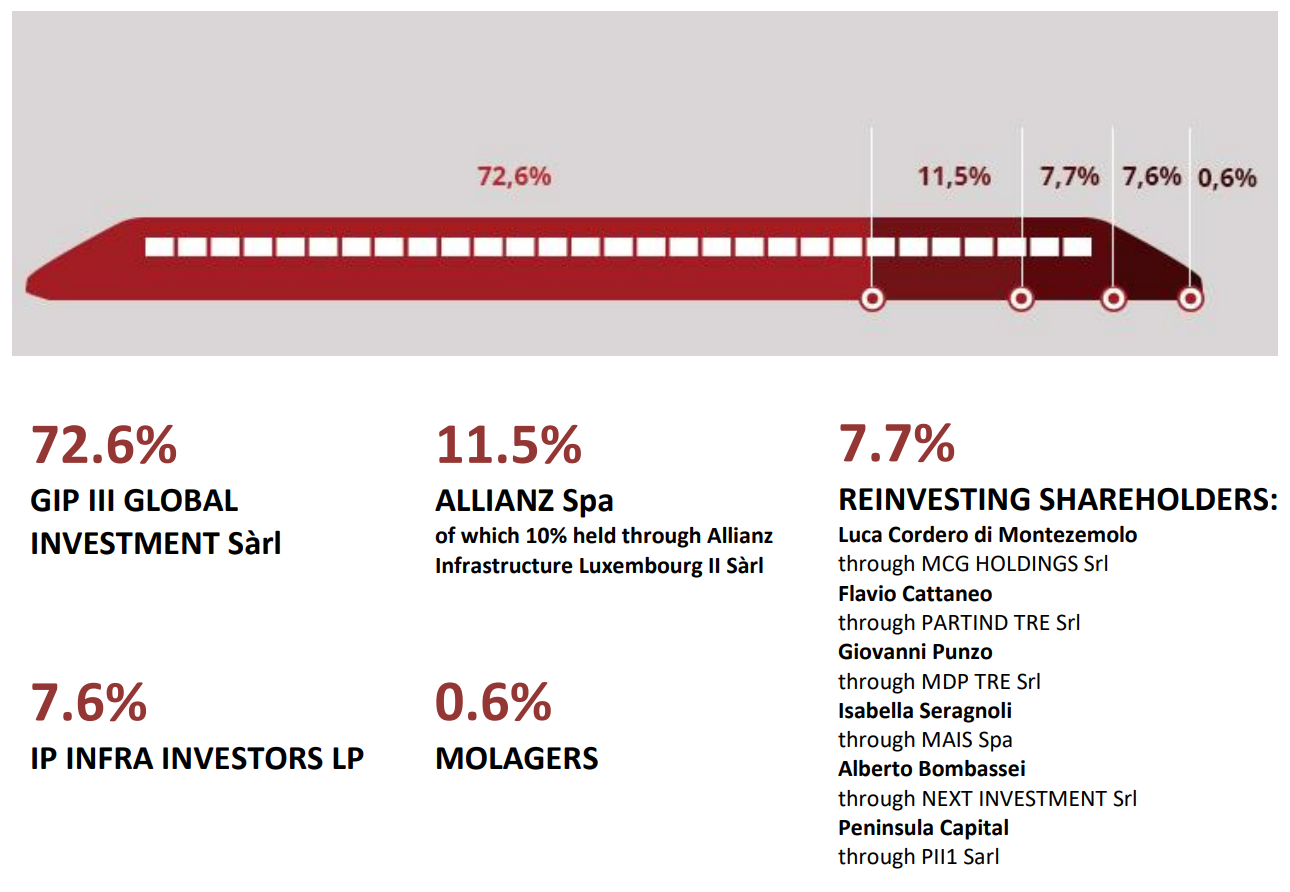

Six months later, in September 2018, the German insurance company Allianz acquired an 11.5% stake in Italo-NTV from Global Infrastructure Partners III (GIP), making Allianz the company’s second-largest shareholder. The precise breakdown was then as follows:

With the advent of Gip, new blood has arrived and a new capital that is sure to guarantee even more dynamism for a group that, in 2018, had already reached 17 million passengers carried in Italy, out of a total of 50 million passengers. As a rail company, NTV-Italo is undoubtedly a great success.

NTV-Italo became a highly profitable company, achieving an Ebitda margin of 35%In 2019, NTV recorded sales of around €700 million and profits of €151.2 million. The company operated 98 routes a day, serving 30 stations in 25 cities.

2020 – The pandemic year

The COVID-19 pandemic first broke out in Italy on January 30, 2020, heralding one of the most serious events of the post-war era. On February 22, 2020, the first two deaths were announced in Casalpusterlengo (Lombardy). On March 22, a decree issued by the Prime Minister prohibited any individual from settling in a commune other than the one in which he or she was located, and a list of other activities not considered necessary, which were to be suspended, was published. All these measures were extended several times, until May 3, 2020. Transport is severely affected, with planes grounded and trains returned to their depots.

During the lockdown, passenger numbers dropped from around 60,000 to just 300 a day!

A slow recovery began in the summer of 2020, in minor mode. But the recovery was piecemeal. The cause: forced ventilation of the closed premises. Aviation soon won its case and was able to fly again, while public transport and regional trains saw measures relaxed more and more. A controversy arose over the air regeneration capacity of long-distance trains. In July 2020, the Health Council ordered that these trains should not exceed 50% of available seats. This meant a loss of 87 trains a day, compared with 112 in the pre-Covid period.

NTV, which had already incurred losses of 200 million in the first half of 2020 as a result of the confinement, considered halting traffic if the 50% occupancy requirement remained in place. In September 2020, CEO Gianbattista La Rocca made no secret of his anger at the different treatment of different modes of transport: “ Planes have been running at 100% for weeks, while local public transport and regional trains have been running at 80%. The situation is therefore unmanageable, and from October 1 we will be forced to reduce services, with serious repercussions for employment. ”

The company boss also claimed that NTV had suspended the distribution of a 151 million euro dividend to shareholders and reduced executive remuneration.

State support

Towards the end of October, Italo-NTV chairman and founder Luca Cordero di Montezemolo announced that services would be immediately suspended if public funds were not received to continue operating. The Minister for Infrastructure and Transport, Paola de Micheli, then declared that the government had allocated resources and that she had informed the European Commission.

She was referring to the stimulus decree announced in May, which would have allocated around €70 million in public funding to the rail sector this year, with a further €80 million due to be made available in 2021. These funds are intended to support rail operators. not subject to public service obligations. In practice, this probably means that the money is shared between Italo-NTV and Trenitalia’s Frecce and Intercity services.

On November 10, 2020, a second confinement reduced traffic to two daily services on the Rome – Venice route and six a day between Naples, Rome, Milan and Turin.

In 2021, things brightened up with two decrees awarding Trenitalia and NTV-Italo €672 million for economic losses incurred in transporting passengers not subject to public service obligations due to the Covid-19 health emergency.

After the European Commission had authorized the measure, Minister Enrico Giovannini signed the two decrees allocating the resources. The first, covering the period from July 1, 2020 to December 31, 2020, allocated €279.8 million to Trenitalia and €91.5 million to Italo-Ntv. The second decree allocated €213.8 million to Trenitalia and €86.5 million to Italo-Ntv for the period from January 1 to April 30, 2021. To these were added the new amounts (364 to Trenitalia and 145.6 to Ntv-Italo) already earmarked for the first phase of the pandemic, from March to June 2020. NTV-Italo had thus benefited from €323.6 million in aid to emerge from the crisis.

2022-2023 – The resale

In September, as NTV-Italo was just recovering from the pandemic, the Bloomberg website announced the GIP fund’s probable intention to pull out. The exit could amount to around 4 billion euros. Remember that the American fund bought 72.6% of NTV in 2018 for 1.98 billion euros, leaving the rest to other investors, including the German insurance company Allianz (11.5%) and some founders who wanted to keep their shares (7.7%).

At the end of October 2022, rumors suggested that the world’s number one container company, MSC, was becoming a serious contender. In the meantime, in May 2023, Italo-NTV acquired Italbus to offer a multimodal service and expand its presence in Italy.

The rumors of a takeover became reality in 2023, with a firm intention to buy and the signing of an agreement in October 2023. In the end, MSC bought a 50% stake, with MSC and GIP exercising joint governance of Italo-NTV with funds managed by Allianz Capital Partners and other co-investors. The deal with MSC valued Italo-NTV at €4.2 billion, including €934 million in debt at December 31, 2022.

2025 – The Azerbaijan as shareholder

Sovereign wealth fund invests €34.5m by joining fund that holds 50% stake in Italo-NTV.

The sovereign wealth fund of Azerbaijan (Sofaz) has invested €34.5 million in the Italian high-speed train operator Italo-NTV. This investment was made by joining a fund managed by Global Infrastructure Partners (GIP), an American company acquired by BlackRock in October 2024. GIP holds 50% of Italo-NTV shares alongside other co-investors, including Sofaz.

The remaining half of the capital is controlled by Mediterranean Shipping Company (MSC), active in European rail freight through its subsidiary Medway. Sofaz highlights that Italo-NTV stands out for its operational performance and strong growth potential, driven by increasing demand for sustainable transport. This strategic investment allows Sofaz to diversify its portfolio with sustainable infrastructure assets, aligning with a long-term investment perspective. 🟧

[TOP]

Main line • High speed Rail • Italy • Lexical